AI's Unstoppable Surge: Tech Stocks Hit Mind-Blowing Highs While One Key Economic Signal Flashes Red

Wall Street witnessed a feeding frenzy on Wednesday as an unstoppable wave of artificial intelligence optimism propelled major stock indexes into uncharted territory, leaving investors wondering just how high this rally can go.

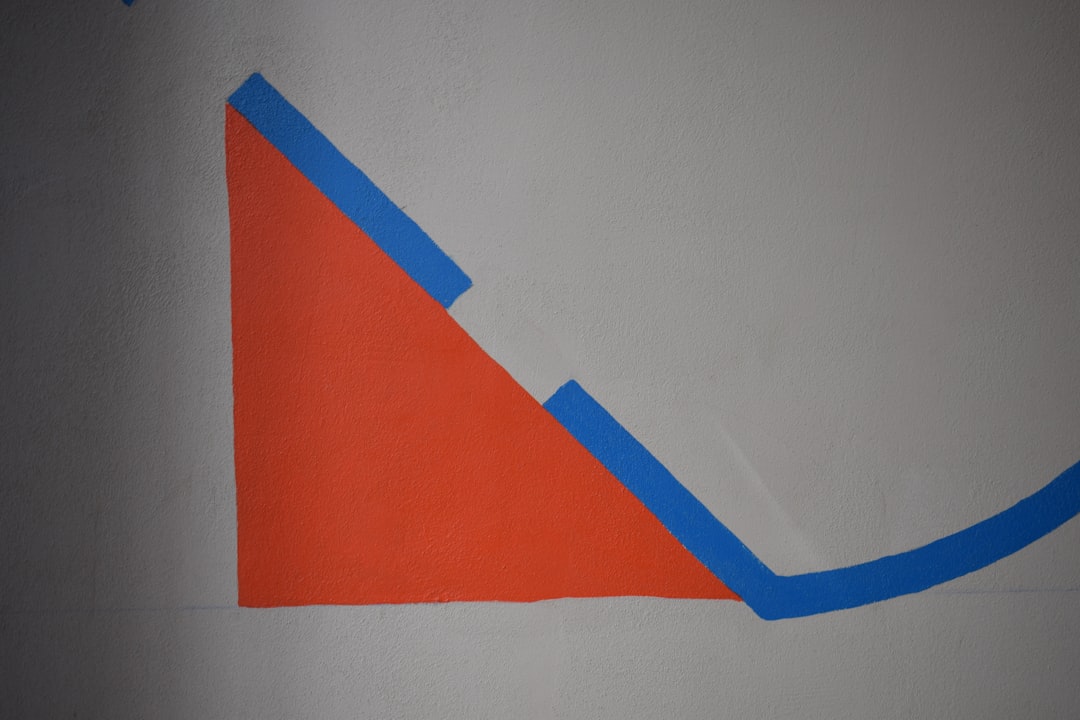

The S&P 500 and the Nasdaq 100 both smashed previous records, closing at fresh all-time highs in a stunning display of market strength. The tech-heavy Nasdaq 100 was the day's clear superstar, rocketing up an impressive +1.19%, while the broader S&P 500 index posted a solid gain of +0.58%. In a sign of just how concentrated the rally was, the Dow Jones Industrials Index finished the day completely flat, highlighting that the current market mania is overwhelmingly centered on one transformative technology.

The AI Gold Rush is On

The engine behind this spectacular ascent? Two letters: A.I.

Investors are pouring capital into anything related to the technology, from semiconductor giants to AI infrastructure firms. The prevailing belief is that the explosive growth in artificial intelligence spending isn't just hype—it's the foundation for the next generation of massive corporate profits. This conviction has turned the market into a one-track-mind, rewarding any company perceived to be a player in the AI revolution.

This bullish sentiment is further supported by a backdrop of a surprisingly resilient U.S. economy and persistent hopes that the Federal Reserve will introduce further easing policies, which could continue to fuel economic activity and support corporate earnings.

A Warning Sign Beneath the Surface?

However, not all signals in the economy are flashing green. Lurking beneath the surface of the market's euphoria, a worrying report emerged from the housing sector. The latest data revealed that U.S. MBA mortgage applications took a steep dive, falling by -4.7% in the most recent week.

This sharp decline, driven by significant drops in both home purchase and refinancing applications, serves as a stark reminder that while the tech sector soars, other critical parts of the economy are facing headwinds. It raises questions about the overall health of the consumer and the sustainability of a market rally that appears increasingly narrow.

For now, the AI narrative is king, drowning out any cautionary whispers. The question on every investor's mind is no longer if AI will reshape the corporate landscape, but how high its stock market tidal wave will crest before reality sets in.